New Financial Year, Fresh Start: Smart Tax & Financial Planning for 2025-26

- Smita Shetty

- Apr 5

- 5 min read

Updated: Apr 5

Smita Shetty

Chartered Accountant (CA); FINANSYS

April isn't just about heatwaves and mangoes, it’s the start of a brand-new financial year. Whether you're 35 and planning for your child's education or 65 and focusing on wealth protection, this is the time to pause, review, and refresh your financial strategy.

Here’s a guide to help you understand what you can do right now to optimize your finances. But first, one important disclaimer:

Check with your Chartered Accountant (CA) or tax advisor to determine whether the Old or New Tax Regime is more beneficial for you. Many of the deductions listed below apply only to the old regime. Once you choose your regime, some of these may or may not apply to your situation — so plan accordingly.

Paying Rent? Claim HRA the Right Way

If you are salaried and your employer provides House Rent Allowance (HRA), you can claim an exemption under the Income Tax Act. This helps reduce your taxable salary. To ensure your claim is valid:

Keep a valid rent agreement in place.

Collect and submit monthly rent receipts.

If the total annual rent exceeds ₹1 lakh, you must provide the landlord’s PAN card….

Always pay rent through traceable methods like bank transfer, UPI, or cheque — it helps if your claim is ever scrutinized.

If you do not receive HRA from your employer, you can claim a deduction under Section 80GG, subject to following conditions

You must not own a home in the city of residence.

The deduction is capped at ₹5,000 per month or 25% of your total income, whichever is less.

To claim the deduction, you must file Form 10BA along with your income tax return.

This is especially useful for consultants, freelancers, retirees, or business owners living on rent. HRA exemption is available in both regimes, but 80GG is only under the Old Regime

Have a Home Loan? Claim Interest and Principal

If you’ve bought a property using a home loan, you can benefit in two ways:

Interest paid on the loan is deductible up to ₹2 lakh per year under Section 24(b) for self-occupied homes. If the house is rented out, there is no cap on the interest amount, but you can only adjust ₹2 lakh of loss under “Income from house property” in the current year; any additional loss is carried forward for 8 years.

Principal repayment is covered under Section 80C, within the ₹1.5 lakh limit. This also includes stamp duty and registration costs in the year of purchase.

In case of joint loans, both borrowers can claim the deduction in their individual returns, effectively doubling the benefit if both are earning.

Supporting Parents or Dealing with Illness?

Section 80D allows health insurance premium deductions — ₹25,000 for self/family and ₹50,000 if you're paying for senior citizen parents.

Section 80DDB provides deductions for expenses incurred on treatment of specific illnesses like cancer, Parkinson’s disease, renal failure, etc. — ₹40,000 for patients below 60, ₹1 lakh if the patient is a senior citizen.

Section 80DD (for disabled dependents) and Section 80U (for self-disability) allow deductions of ₹75,000 to ₹1.25 lakh based on the severity.

Disabilities such as hearing impairment, blindness, mental illness, and locomotor disability are eligible. A Form 10-IA from a certified doctor must be submitted.

Ensure you retain medical prescriptions, diagnostic reports, and payment receipts for all claims.

Use the Full Range of Deductions

Make sure to fully utilize the available deductions:

80C: ₹1.5 lakh from investments in PPF, ELSS mutual funds, life insurance, tuition fees, home loan principal, 5-year FDs.

80CCD(1B): ₹50,000 extra for NPS contributions over the 80C limit.

80D: Health insurance premiums as described above.

80TTA / 80TTB: Interest from savings accounts — ₹10,000 for those under 60, ₹50,000 for senior citizens

Running a Side Hustle or Self-Employed? Save with Presumptive Taxation

If you're a freelancer, consultant, or small business owner:

Section 44AD (businesses) allows you to declare 8% of gross receipts (6% if digital) as your income if turnover is less than ₹3 crore.

Section 44ADA is meant for professionals such as doctors, chartered accountants, architects, lawyers, and others listed under the Act. It allows them to declare 50% of gross receipts as income under the presumptive scheme if gross receipts are up to ₹50 lakh. This limit can be extended to ₹75 lakh if total cash receipts do not exceed 5% of total receipts.

You are not required to maintain detailed books of accounts or get your accounts audited under these schemes.

Apart from the presumptive income, you can still claim deductions under 80C, 80D, etc., like salaried individuals.

This greatly simplifies tax compliance while offering substantial tax relief.

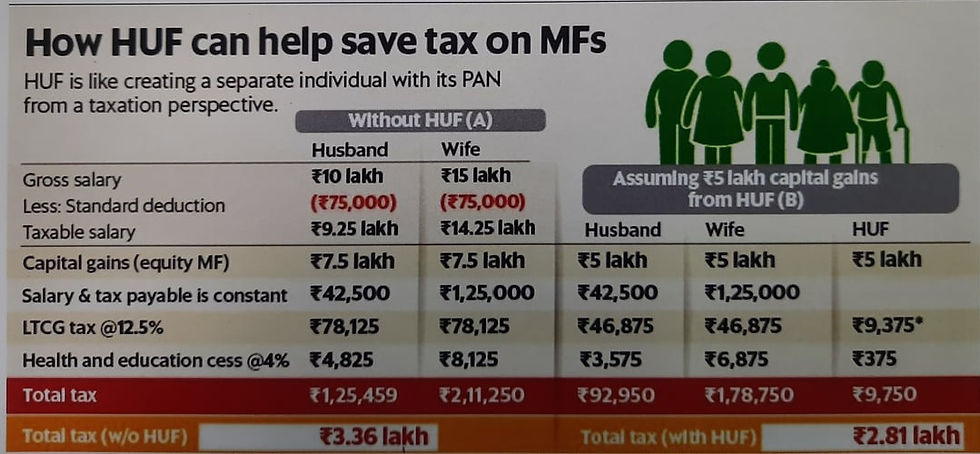

Create a Hindu Undivided Family (HUF) for Smart Family Tax Planning

A HUF is a separate legal entity that can help in tax planning for families. It can be created by any Hindu, Sikh, Jain, or Buddhist male who is married and forms a family unit.

Benefits:

HUF has a separate PAN and can file its own tax return.

It enjoys a separate basic exemption limit of ₹2.5 lakh.

It can invest in fixed deposits, mutual funds, or hold rental properties and pay tax separately on that income.

You can claim deductions like 80C, 80D under the HUF as well.

It is especially beneficial for families with ancestral property or joint investments, allowing income to be split and taxed efficiently.

Start SIPs — Don’t Wait Till March to Invest ..

One of the biggest mistakes is leaving tax-saving investments till the end of the year. Instead, start a monthly Systematic Investment Plan (SIP) now:

₹25,000/month at an assumed 12% annual return over 20 years could grow to ₹2.3 crore.

ELSS mutual funds (under 80C), PPF, and NPS all support monthly investing.

Monthly contributions are easier to manage and give better rupee cost averaging over time.

Early and consistent investing is what truly creates wealth.

Often Ignored but Valuable Deductions

Section 80E: Interest on education loan — no upper limit, deductible for 8 years from the year repayment starts.

Section 80G: Donations to eligible charitable institutions. Only donations made through non-cash modes (cheque, UPI, card, etc.) qualify. Cash donations above ₹2,000 are not allowed as deductions.

Capital Gains Planning:

Section 54: Exemption on capital gains from sale of a residential property if reinvested in another residential property.

Section 54F: For capital gains on assets other than house property.

Section 54EC: Allows investment in specified bonds (NHAI/REC) to save capital gains tax.

If you sell ancestral property, the same rules apply — the capital gain is calculated based on indexed cost from the date of acquisition, and exemptions can be claimed based on reinvestment.

Form 15H / 15G: If your income is below the taxable limit, submit this to banks to avoid unnecessary TDS deductions on interest.

Final Word: Financial Planning Isn’t One-Size-Fits-All

Whether you're 40, navigating EMIs and school fees, or 65, focusing on wealth preservation and tax-free income — planning ahead gives you control and clarity.

April is the best time to:

Review last year’s spend and investments

Create a tax-saving and investment plan

Choose the right tax regime based on your financial goals

Source: FINANSYS

Comments